The COVID-19 pandemic is changing life as we know it. The sudden need to do everything from working to acquiring groceries to handling financial matters remotely only accelerated a paradigm-shifting trend that was already on our doorsteps. The always-on, always-digital customer experience must function seamlessly across the hundreds of channels and devices people use today.

This customer experience is the “battlefront” upon which businesses will compete. In their Retailing 2020 report, PwC states the percentage of companies investing in an omnichannel customer experience jumped from 20% in their Retailing 2015 report to more than 80%. And it seems these investments are for the best, considering that the Forrester Total Economic Impact Study found that companies with strong omnichannel strategies experience 10% YoY growth, a 10% increase in average order value, and 25% growth in close rates.

In the special COVID-19 edition of The CMO Survey, marketing professionals noted a 10% increase in marketing spend in the customer experience category since February. However, spending on specific omnichannel outlets such as mobile (70%) and social media (74%) increased drastically during the pandemic — and is sure to keep rising.

While many sectors like travel and entertainment have been ravaged and will likely be forever changed in the wake of COVID-19, the financial services industry has been lucky to be relatively unscathed so far. Instead of re-imagining how they function and where they belong globally, banks and financial services providers need to catch up with the digital and technological trends that were already on their way to transforming the customer experience.

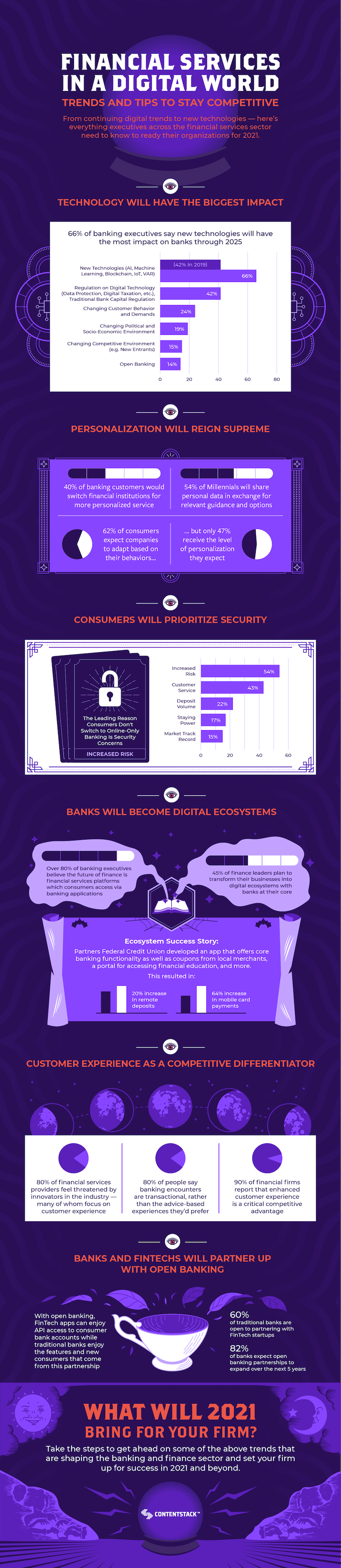

This infographic shares trends and tips about the technologies banks and financial services providers can adopt to take advantage of digital trends and create seamless omnichannel experiences in 2021 and beyond.